An irrevocable life insurance trust (ILIT) is an estate planning vehicle worth some consideration for U.S. citizens living in Canada. Many estate advisors are unaware that U.S. citizens subscribing to life insurance on their life will have the death benefits included in the value of their taxable estate for U.S….

Category: Succession Planning

In the estates context, undue influence is often alleged in order to challenge a will or an inter vivos transfer of property, often a family home or cottage. When a party in a legal dispute alleges that there was undue influence which party bears the burden of proving (or disproving)…

This blog has been written by Lily MacLeod [Associate] at Fasken LLP It is common for an elderly parent to set up a joint bank account with their adult child. This enables the child to help manage the parent’s finances freely and efficiently (either as the parent’s attorney for property…

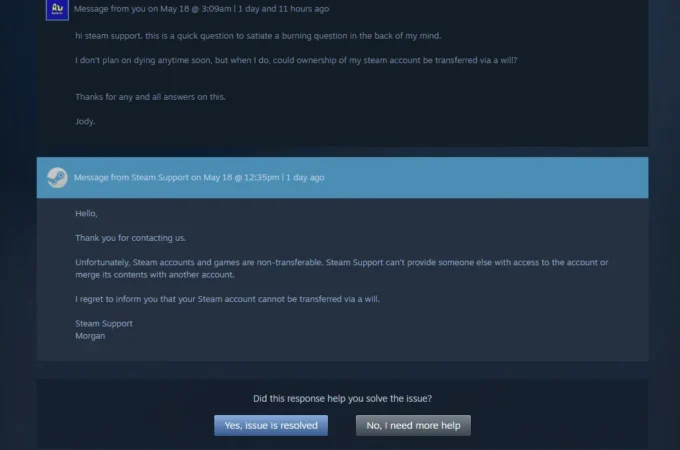

Pictured: A screenshot of a discussion between a Steam user and a Steam Support representative that has taken the internet by storm. Usually, I get my trusts and estates-related news from legal blogs, LinkedIn or emails from colleagues. So, you can imagine my surprise when I stumbled upon a pretty…

What are the tax implications if you are a beneficiary of a U.S. estate? Rarely do we consider the implications of a Canadian resident inheriting from a U.S. estate. From a Canadian Tax Perspective The general rule is the Canadian beneficiary shall receive their inheritance tax-free since the U.S. estate…

This blog has been written by Rahul Sharma, Partner, Fasken Martineau DuMoulin LLP, Toronto Nearly a year ago, I made a post on this blog entitled “Breaking Up is Hard to Do – Ceasing to be a Canadian Tax Resident may be Easier Said than Done” (Breaking Up is Hard…

Having come into force on January 1, 2022, Section 21.1 is a relatively recent addition to the Succession Law Reform Act (“SLRA”). Section 21.1 is a validating provision, which allows the courts discretion to declare a will valid even if it does not meet the formalities of execution set out…

Part III – Corporate Attribution This blog post has been written by Pritika Deepak, Associate at Fasken LLP. This is the last part of a three-part blog series which provides a high level overview of the attribution rules contained in the Income Tax Act (Canada)[1] (the “Act”). Part I, which…

Anna Chen, Associate, Gowling WLG (Canada) LLP In the recent decision, The Estate of William Harper,[1] the Court was asked to determine whether a two page beneficiary designation form that was missing its first page (the page on which the account number would be indicated) and not processed by the…

Today, over half of Canadians own a pet. However, a recent survey shows only 7% of pet owners have made formal arrangements for them. If there is no provision in your estate plans, your beloved pet might not be taken care of in the manner to which they’ve become accustomed.