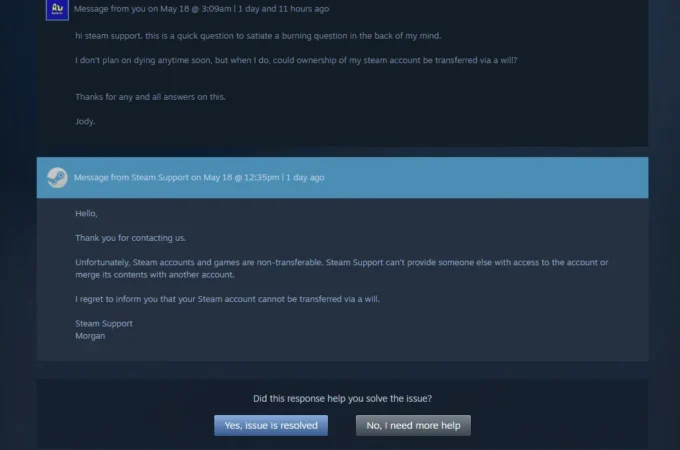

Pictured: A screenshot of a discussion between a Steam user and a Steam Support representative that has taken the internet by storm. Usually, I get my trusts and estates-related news from legal blogs, LinkedIn or emails from colleagues. So, you can imagine my surprise when I stumbled upon a pretty…

Tag: digital assets

Pictured: Some myosotis flowers; colloquially known as “forget-me-nots”. I thought these would be appropriate for this blog post. In the estate planning world, we often see clients who want to be remembered for generations to come. For example, this could be through establishing a charitable gift, trust or foundation in…

For my last blog post, I discussed the potential financial value of an individual’s “personalty” and clauses in wills governing such personalty. While an individual’s more traditional assets may include bank accounts, real estate or vehicles, there may also be some other personal items (e.g. collections) that may have significant…

While I enjoy writing about the legal aspects of digital assets in estate planning and administration, I don’t think that I have spent enough time focusing on the work of the wonderful advisors in this space: technology consultants, lawyers and policy analysts among them. The efforts of these advisors have…

Today’s blog post was written in collaboration with Adele Ambrose – Student-at-Law at Fasken. This is the second part in a two-part blog series that explores the specific client considerations for digital assets in estate planning. In Part I, we took a look at the digital assets landscape in Canada…

Today’s blog post was written in collaboration with Adele Ambrose – Student-at-Law at Fasken. It has become clear that the “wait and see” approach to digital assets and digital currency has now shifted to a need for prudent guidance and action by advisors and institutions. According to CoinMarketCap, the total…

Do digital assets e.g. cryptocurrencies (such as bitcoin, ethereum) non-fungible tokens, qualify as investments in deferred tax vehicles such as Registered Retirement Savings Plans (RRSP’s), Tax Free Savings Accounts (TFSA’s), Registered Education Savings Plans (RESP’s) and Registered Disability Savings Plan (“RDSP’s). The simple answer is no and maybe. This issue…

When it comes to estate planning for one’s digital assets, it is now no secret that, depending on the organization(s) involved, options can be limited. This is particularly the case for online accounts. A few years ago, Fasken published a bulletin titled “Estate Planning and Online Accounts”. This bulletin examined…

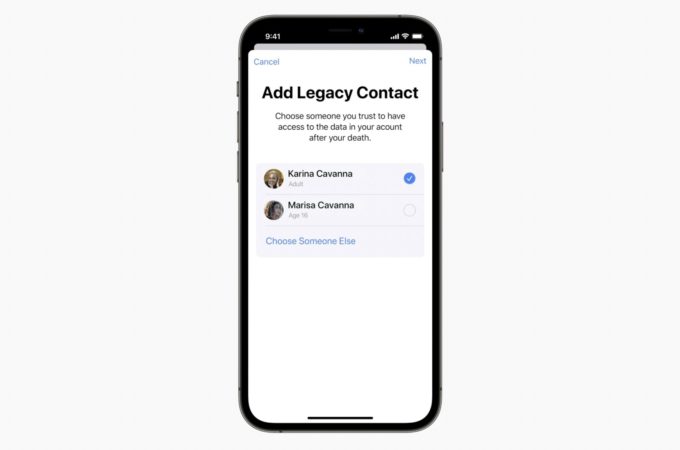

This Blog was written by: Dave Madan, Market Lead and Manager, Scotiatrust Estate planning has evolved recently. We have learned how our digital accounts are affected by our plan, how to deal with online accounts such as PayPal, Facebook, Google, and Apple, however, it has continued to evolve even further….

Today’s Executor is a Digital Executor The estates and trusts world has taken notice of the importance of digital assets—there is no question about that. Now that we know that an individual’s digital assets are something that advisors and clients alike need to consider for every estate planning matter, the…