When it comes to estate planning for one’s digital assets, it is now no secret that, depending on the organization(s) involved, options can be limited. This is particularly the case for online accounts.

A few years ago, Fasken published a bulletin titled “Estate Planning and Online Accounts”. This bulletin examined a selection of major technology companies’ approaches to dealing with a deceased user’s account. Few companies allowed for any sort of transfer or preservation of the online account. While the majority of these companies did allow for the closure of a deceased user’s account, some did not even have a straightforward process (i.e. online form) for requesting this closure.

That being said, as the discussion around digital assets and estate planning has grown colossally over the last several years, it seems that numerous technology companies are now providing dedicated, integrated processes for post-death account management.

Several months ago, professional networking platform LinkedIn introduced an account “memorialization” service for deceased user’s accounts. This “memorialization” concept was most notably introduced by Facebook and Instagram. In essence, memorialization “preserves” a user’s account. In the LinkedIn context, memorialization essentially closes the account from future access by anyone. However, the profile remains publicly searchable and includes an “in remembrance” badge. Thus, the difference between traditional account closure and memorialization is that the latter causes the profile associated with the account to act as a sort of public “digital tombstone”. Lastly, note that only an “authorized person” with respect to the deceased user (presumably including an executor of their estate) can request memorialization.

Prior to adding its memorization service, LinkedIn only allowed requests for the removal of a deceased user’s account. LinkedIn’s memorialization process is a welcome step forward, although unlike other memorialization services a user cannot dictate in advance what is to happen to their own account upon their death. Memorialization can only be implemented after one’s death. If an individual would not want their account memorialized after their death, their only option for giving effect to this wish would be to convey it to their executors and trustees and close relatives, or otherwise codify it in their estate planning documents.

Apple

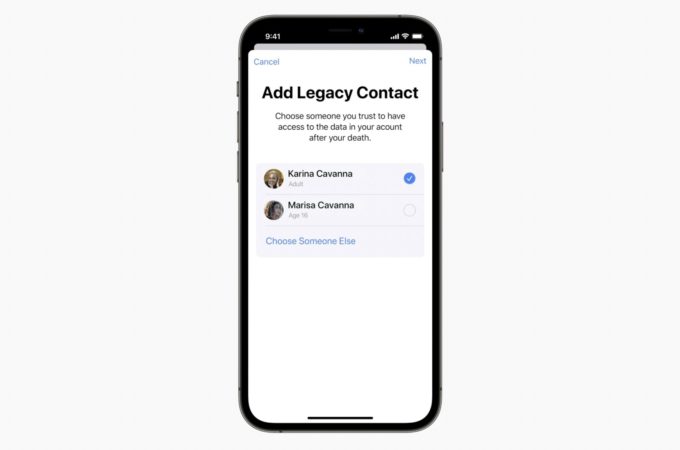

In contrast, hardware and software giant Apple has introduced a new feature for account legacy planning that requires proactive planning on the part of the user. Announced at its WWDC 2021, Apple’s “Digital legacy” feature will allow users to designate “legacy contacts”. A person who is designated as a legacy contact can, upon the death of the user, request access to the relevant account contents. Apple will require a death certificate of the deceased user to facilitate this.

There are still numerous things about the new feature that are unclear. For example, it remains to be seen whether legacy contacts must also own Apple devices/have an Apple account (although the announcement video suggests that this is the case). It is also unclear if anything can be done with the account contents if a user has not designated a legacy contact. Apple plans to launch this feature in Autumn 2021.

It will be interesting to see how Apple implements this feature, as it may mark the beginning of a huge societal attitude shift towards estate planning. Reports indicate that over 700 million people use iPhones worldwide. So, depending on how Apple rolls out and informs its users of this feature, we could possibly see hundreds of millions of people around the world pay greater attention to their legacy planning not only with respect to their Apple devices and accounts but perhaps to their other assets as well.

Future Developments

These recent evolutions in tech company attitudes towards legacy planning only further demonstrate the importance of estate planning for digital assets. It is likely that organizations will offer varying forms of digital legacy planning in this regard. However, make no mistake: these types of features have probably come with a sizeable cost for organizations to implement, administer and maintain. While ideally every type of online organization should implement this type of planning for its users, the likely reality is that only the largest organizations will be able to sustain it.

That being said, any development is better than no development. And in the same way organizations are encouraged to offer legacy planning to avoid issues with the loved ones of deceased users, there is an impetus on user themselves to be proactive in their estate planning. As we are seeing in the world of digital assets and estate planning, the requisite tools are becoming more and more available. However, such tools cannot be useful if we are not encouraging people to actually use them.

2 Comments

Holly Ann Knott

July 30, 2021 - 5:41 pmThank you, Demetre. This is an important area for estate planning, and I appreciate your informing us of recent changes.

Lee Poskanzer

July 30, 2021 - 7:28 pmCongratulations to online content providers to bringing more attention and offering services for the handling a deceased account holder’s affairs. It’s good to see online content providers creating new ways for addressing the need for data and contents necessary to settle one’s affairs. It’s big first step to but there’s still a ways to go.

These proprietary offerings also come complications that account holders and lawyers need to know. They can deliver real problems and unintended consequences for the estate and its representatives. These features don’t consider potential account holder behavior or consider status changes interpersonal relationships. They rely on the account holder to remember to make all changes to disclosure decisions and designees. We all know that it’s already difficult enough to get them to make decisions on their estate. After the initial decisions recorded on the content provider’s proprietary page, it’s up to account holder to change those choices if a relationship deteriorates designated data recipient, regardless of the reason (death, divorce, losing touch, etc…) And if a person has 100+ accounts, each with its own proprietary “inactive” or “legacy management” option, what’s the reality of the account holder getting around to making the necessary designee changes to all of them? It’s probably very low. Missing that change, means data being distributed to a dead end or, worse, an unfriendly recipient.

Even if the designee maintains an active relationship with the account holder, they may not know of their responsibility is to evaluate for important data. Are they prepared to contact the estate representatives, if necessary? Will they have time and wherewithal to review the contents? Will they miss expiry dates and be in time for data auto-deletion policies? And what is their liability if they overlook something causing financial or sentimental loss?

Making it even more challenging, content providers may consider the very act of assigning a disclosure as a private communication. This designation may not disclosed to the estate, thus make the representatives and loved ones to do some detective work.

Many US states recently enacted Revised Uniform Fiduciary Access to Digital Access Act (RUFADAA) that establishes a preferential treatment to a directive made using a content provider’s proprietary tool. With a majority of content providers based in the US, these new laws will have direct impact on Canadian residents producing a direct conflict with a will or trust disposition instructions.

Lastly and more specifically, legacy content managers options, such as Facebook’s feature can create a false confidence. The manager’s powers and access to a decedent’s account activities are limited. They’re able to create posts on the deceased account holder’s profile such as celebrations of life, pictures, etc… But they don’t have access to communications, personal profile information, and other data that may be needed by an estate. Selecting this option is not the same as assigning the disclosure of contents. I’ll bet most account holders don’t know the difference.

Kudos to Mr. Vasilounis for calling attention to these advancements in our category. He brings to light many of the issues and questions that are now facing lawyers and individuals thinking about a plan for digital asset plan. He rightfully points out that the likelihood of account holders using these options in any scale is low. That is unless content providers make this area a priority. If they do in the future, we can count on new difficulties for estate preparation and administration. Account holders, lawyers and representatives need to be aware of the benefits and pitfalls that come content provider program options.